Paid $100K+ in Taxes Last Year?

You Could Be Missing Out On Tax Strategies

Stop Overpaying $100K+ in Taxes

High-earning doctors and business owners often discover overlooked tax strategies when they go beyond tax filing and into proactive planning.

MANY high earners MISS OUT ON TAX STRATEGIES.

Doctors, dentists, and business owners who paid $100,000 or more in taxes last year often discover opportunities for savings with proactive planning.

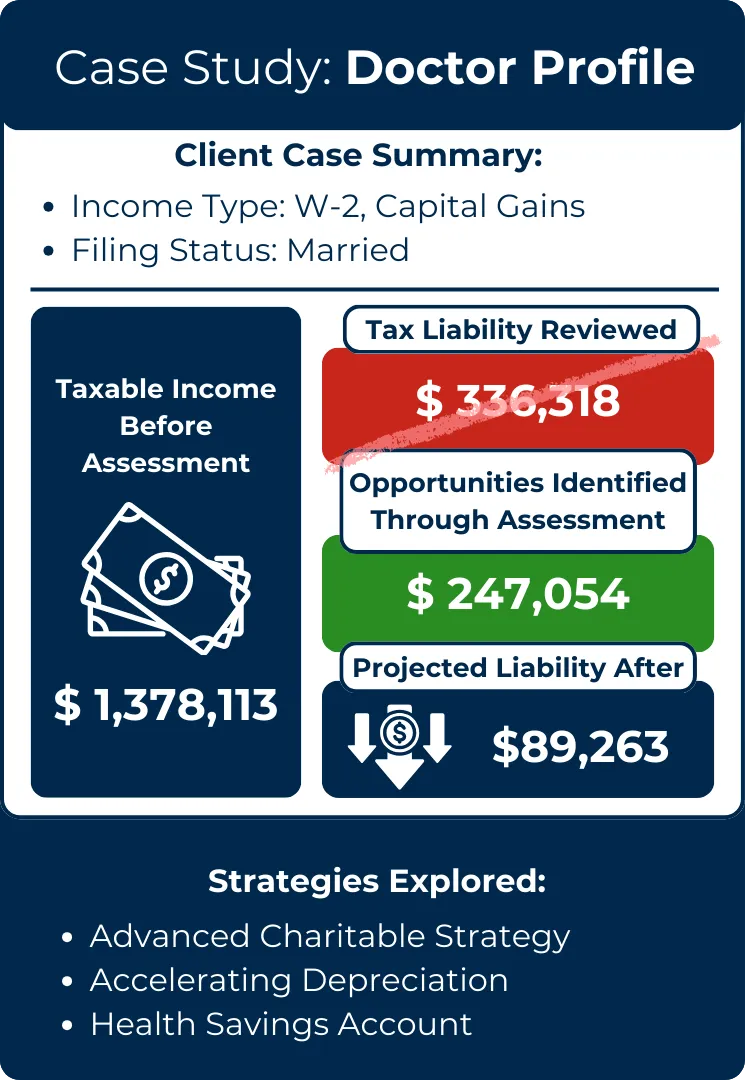

In past assessments, clients have identified significant missed savings — sometimes even six figures.

You don’t need a new CPA — you need a proactive approach.

Testimonials

John Doe

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Jane Doe

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

How It Works

Simple 3-Step Process

Point of Clarity Call

We discuss your situation and see if you qualify.

Assessment

We identify overlooked opportunities and build a personalized tax plan.

Advisory Program

We implement and optimize year after year.

It all starts with your free call

Kevin Andrade, CPA & Tax Advisor

Owner & Founder of Spark tax services lLC

Tax planning expert with over 10 years of experience helping business owners and medical professionals take a proactive approach to their taxes. His clients have identified millions in potential tax-saving opportunities through strategies that go beyond traditional filing.

SEE WHAT OTHERs are saying

Hear from clients themselves about their experience with proactive tax planning

and our advisory program.

Michael Shares His Experience In

Our Advisory Program

Kris & Aly Found Value In

Proactive Planning

Brian Talks About His Results In Working With Us

case study

Ready to DISCOVER MISSED TAX STRATEGIES?

Many high earners are surprised by what proactive planning uncovers.

© 2025 Spark Tax Services. All rights reserved.